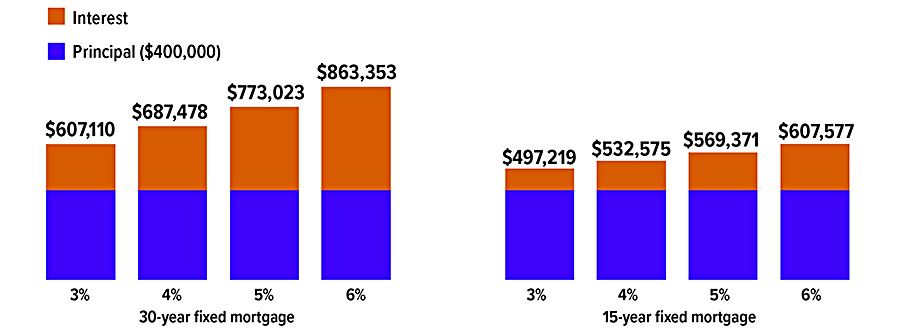

In April 2022, the average interest rate for a 30-year fixed mortgage surpassed 5% for the first time since April 2010, and it was still above 5% in August. With higher rates, it’s more important than ever to understand how interest increases the total cost of a mortgage.

The chart below shows the total cost for a $400,000 conventional 30-year fixed mortgage and an accelerated 15-year fixed mortgage (typically used for refinancing) at different interest rates. A $400,000 mortgage would enable a buyer to purchase a $500,000 home with a 20% down payment.

Source: Freddie Mac, 2022. This hypothetical example of mathematical principles is used for illustrative purposes only. Actual results will vary.

Prepared by Broadridge Advisor Solutions Copyright 2022.

Probate is the process of proving the validity of a will and supervising the administration of an estate usually in the probate court. State law governs the proceedings in the probate court, so the process can vary from state to state. Supervising the administration of an estate can result in additional expense, unwanted publicity, and delays in the distribution of estate assets for a year or longer, which is why planning to avoid the probate process may be beneficial.

There are several ways in which assets may transfer on death directly from the decedent/owner to others without probate. The following are some of the more common ways.

Create a living trust. A revocable living trust is a separate legal entity that can be set up to hold assets. You can transfer most assets to a living trust while you’re alive and have complete access to and control of those assets during your lifetime. You can also direct who is to receive assets held in trust upon your death. The use of trusts involves a complex web of tax rules and regulations, and usually involves upfront costs and ongoing administrative fees. You should consider the counsel of an experienced estate planning professional before implementing a trust strategy.

Name a beneficiary. Many types of contracts allow you, as the account owner, to designate a beneficiary or beneficiaries to receive the assets directly upon your death, avoiding probate. Examples include life insurance, annuities, and retirement accounts such as IRAs and 401(k)s.

Make accounts payable on death. Certain other types of accounts, such as bank accounts and brokerage accounts, also allow you to designate a beneficiary to inherit the account at your death without going through probate.

Own real estate jointly or create a life estate. Owning property jointly, as joint tenants with rights of survivorship, is another way to transfer property at death while avoiding probate. When one joint owner dies, property ownership automatically transfers to the surviving joint owner. You can also create a life estate in the property. In this case, you transfer ownership of the property to others, often called remainder beneficiaries, while you retain a life estate in the property. This means you have the right to use and control the property during your lifetime. Upon your death, complete ownership of the property passes to the remainder beneficiaries.

Prepared by Broadridge Advisor Solutions Copyright 2022.

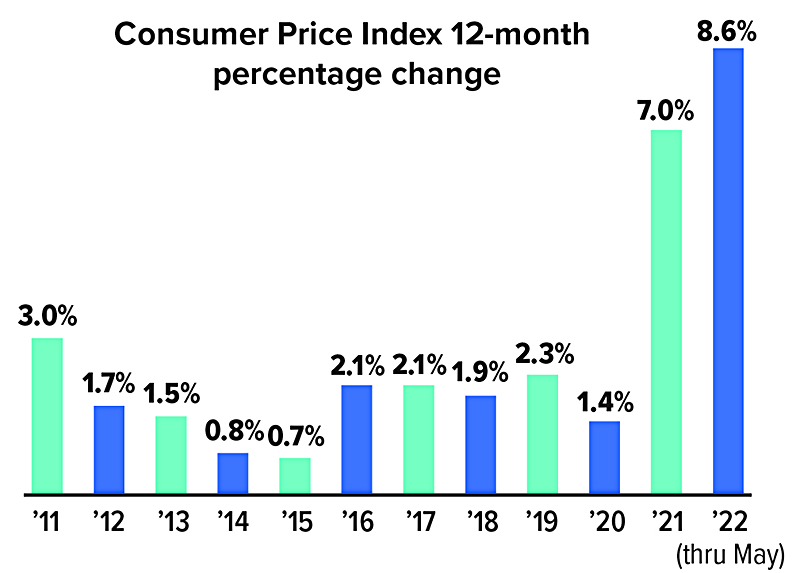

For the 12-month period ending in May 2022, the Consumer Price Index for All Urban Consumers (CPI-U) — the most widely used measure of inflation — increased 8.6%, the fastest pace in 40 years.1 The rate may trend downward as the Federal Reserve raises interest rates and supply-chain issues improve. But inflation is likely to be relatively high for some time.

High inflation not only hits consumers in the pocketbook for current spending, it also has a negative impact on the future purchasing power of fixed-income investments. For example, a hypothetical investment earning 5% annually would have a real return of –2.5% during a period of 7.5% annual inflation. This rate of return might be further reduced by taxes.

One way to help hedge your bond portfolio against inflation is by investing in Treasury Inflation-Protected Securities (TIPS).

How TIPS Fight Inflation

The principal value of TIPS is automatically adjusted twice a year to match any increases or decreases in the Consumer Price Index. If the CPI-U moves up or down, the Treasury recalculates your principal to reflect the change. A fixed rate of interest is paid twice a year based on the current principal, so the amount of interest may also fluctuate. Thus, you are trading the certainty of knowing exactly how much interest you’ll receive for the assurance that your investment will maintain its purchasing power over time.

Like all Treasury securities, TIPS are guaranteed by the federal government as to the timely payment of principal and interest. If you hold TIPS to maturity, you will receive the greater of the inflation-adjusted principal or the amount of your original investment.

Pricing-In Protection

TIPS pay lower interest rates than equivalent Treasury securities that don’t adjust for inflation. The breakeven inflation rate is the difference between the yield of TIPS and nominal (non-inflation-protected) Treasury securities with similar maturities. It is the premium the investor pays for inflation protection, as well as a market-based measure of expected inflation.

If inflation runs higher than expected, TIPS will earn a better return than nominal Treasury securities. If inflation runs below the breakeven rate, then TIPS have no clear advantage. However, the increased principal due to any level of inflation can still add to the value of your portfolio.

In some situations, TIPS can have negative interest rates that might produce a positive return after the principal is increased for inflation. For example, if a five-year TIPS offers a return of –0.5% while a five-year Treasury note offers a return of 2.5%, the 3% difference between these rates is the breakeven inflation rate. If inflation were to run at 4% over the five-year period, the TIPS would return 3.5% (4% – 0.5%) after adjustments for inflation, 1% higher than the return on the Treasury note.2

Eroding Purchasing Power

After an extended period of low inflation, consumer prices spiked in 2021 and 2022 due to supply and demand imbalances as the U.S. economy reopened.

TIPS are sold in $100 increments and are available in maturities of 5, 10, and 30 years. As with all bonds, the return and principal value of TIPS on the secondary market will vary with market conditions, are sensitive to movements in interest rates, and may be worth more or less than their original cost. When interest rates rise, the value of existing TIPS will typically fall on the secondary market. Changing rates and secondary-market values should not affect the principal of TIPS held to maturity.

You must pay federal income tax each year on the interest income from TIPS plus any increase in principal, even though you won’t receive the principal and interest until the bonds mature. For this reason, investors might consider holding TIPS in a tax-deferred account such as an IRA.1) U.S. Bureau of Labor Statistics, 2022

2) This hypothetical example of mathematical principles is used for illustrative purposes only. Rates of return will vary over time, particularly for long-term investments. Actual results will vary.

Prepared by Broadridge Advisor Solutions Copyright 2022.

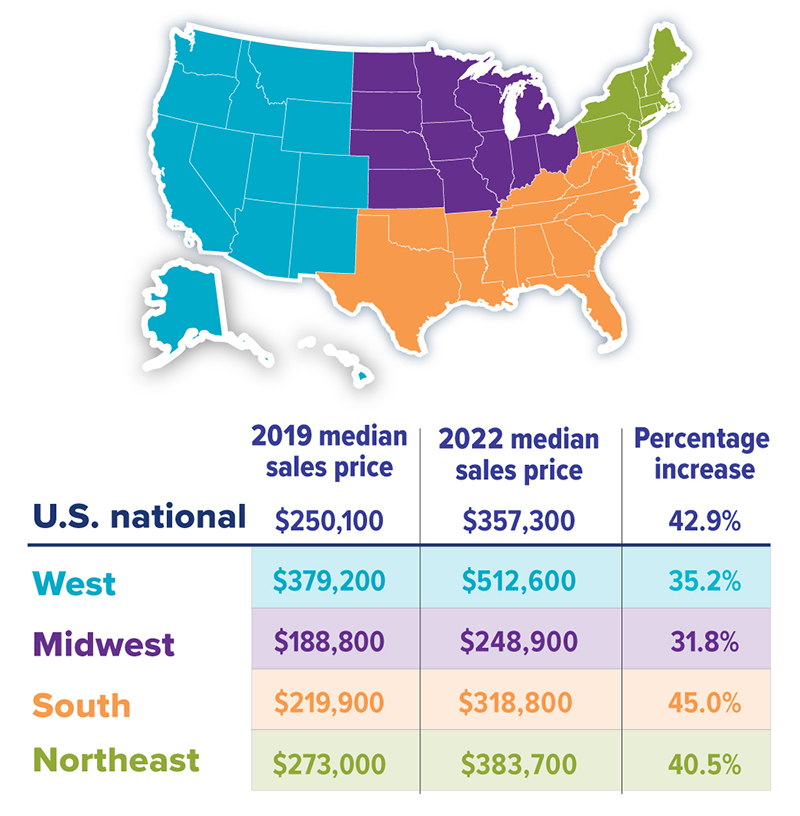

With home values skyrocketing recently, your home may be one of your largest assets. Using home equity to help finance other financial objectives is a strategy many people consider, but before doing so be sure you understand the risks as well as the potential benefits.

Home equity is the difference between how much your home is worth, based on current market conditions, minus your mortgage balance. Let’s say your home is worth $450,000 in the current market and your outstanding mortgage is $250,000. That means you have $200,000 in equity.

In most cases, lenders will allow you to borrow up to 80% of your home’s value minus your mortgage balance. In the example above, the total amount you might borrow would be $110,000 (assuming you qualify).

It’s probably best to be as conservative as possible when using home equity. There’s no guarantee that your home will maintain its current market value, so you could end up owing more than it’s worth. Moreover, in the unfortunate event of default, you could lose your house.

How to Access Home Equity

Generally, there are three ways to access home equity:

1. Cash-out refinance: In a cash-out refinance, you would refinance your mortgage for more than what you owe and take the difference in cash.

2. Home equity loan: With this type of loan, you would leave your current mortgage untouched and take out a separate loan against the equity in your home, with a fixed interest rate and fixed monthly payments.

3. Home equity line of credit: A HELOC works much like a credit card. You apply for a revolving credit amount up to a certain limit and, upon approval, have access to that money for a specific period, known as the draw period (usually 10 years). HELOC funds don’t all have to be used right away or at the same time. You can usually access the funds as needed by writing a check or using a linked credit card. Interest rates are variable; required payments will depend on how much you borrow and the prevailing rate. When the draw period ends, all outstanding balances need to be repaid.

Keep in mind that each of these options will have specific fees, including appraisal fees. A refinance could also require closing costs, which can equal thousands of dollars, depending on the amount borrowed.

The best type of loan will depend on your specific situation. If you need a fixed amount of money, a cash-out refinance or home equity loan might be appropriate. If you need an indeterminate amount over time or seek an emergency cash reserve, a HELOC might better serve your needs.

Growth in Home Sales Prices Since 2019

When Using Home Equity Might Make Sense

Because you’re putting your home at risk, it’s important to think critically and strategically when using home equity. Are you using the funds in a way that could reap future financial benefits, such as home repairs and improvements, helping to pay for a child’s college education, or consolidating high-interest debt? Then it might make sense. (A loan used for home repairs may also offer tax benefits; talk to a tax professional.) On the other hand, it might not be in your best financial interest if you’re thinking of using the money to fund an extravagant purchase, such as an expensive vacation or new luxury car.

Home equity loans and lines of credit that are not used to buy, build, or substantially improve your primary home (or a second home) are considered home equity debt; you cannot deduct the interest on home equity debt. With a cash-out refinance, you can only deduct interest on the new loan if you use the cash to make a capital improvement on your property.

Prepared by Broadridge Advisor Solutions Copyright 2022.

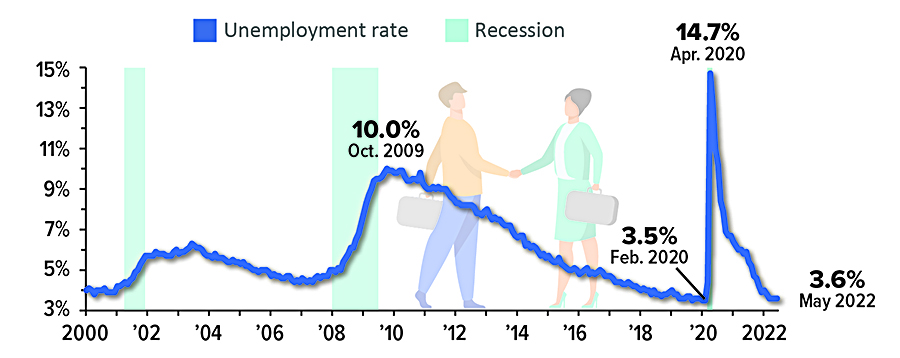

The U.S. unemployment rate skyrocketed to 14.7% in April 2020 when the economy shut down in response to the pandemic. This was by far the highest rate since the current tracking system began in 1948. Fortunately, employment has recovered at a record pace — the unemployment rate was just 3.6% in March, April, and May 2022, nearly the same as before the pandemic.

The official unemployment rate only reflects unemployed workers who are actively looking for a job. A broader measure that captures workers who want a job but are not actively looking, as well as part-time workers who want full-time work, dropped from 22.9% in April 2020 to 7.1% in May 2022.

Prepared by Broadridge Advisor Solutions Copyright 2022.