Maintaining an appropriate balance of stocks and bonds is one of the most fundamental concepts in constructing an investment portfolio. Stocks provide greater growth potential with higher risk and relatively low income; bonds tend to be more stable, with modest potential for growth and higher income. Together, they may result in a less volatile portfolio that might not grow as fast as a stock-only portfolio during a rising market, but may not lose as much during a market downturn.

Three Objectives

Balanced mutual funds attempt to follow a similar strategy. The fund manager typically strives for a specific mix, such as 60% stocks and 40% bonds, but the balance might vary within limits spelled out in the prospectus. These funds generally have three objectives: conserve principal, provide income, and pursue long-term growth. Of course, there is no guarantee that a fund will meet its objectives.

When investing in a balanced fund, you should consider the fund’s asset mix, objectives, and the rebalancing guidelines as the asset mix changes due to market performance. The fund manager may rebalance to keep a balanced fund on track, but this could create a taxable event for investors if the fund is not held in a tax-deferred account.

Core Holding

Unlike “funds of funds,” which hold a variety of broad-based funds and are often meant to be an investor’s only holding, balanced funds typically include individual stocks and bonds. They are generally not intended to be the only investment in a portfolio, because they might not be sufficiently diversified. Instead, a balanced fund could be a core holding that enables you to pursue diversification and other goals through a wider range of investments.

You may want to invest in other asset classes, hold a wider variety of individual securities, and/or add funds that focus on different types of stocks or bonds than those in the balanced fund. And you might want to pursue an asset allocation strategy that differs from the allocation in the fund. For example, holding 60% stocks and 40% bonds in a portfolio might be too conservative for a younger investor and too aggressive for a retired investor, but a balanced fund with that allocation could play an important role in the portfolio of either investor.

Heavier on Stocks or Bonds?

Balanced funds typically hold a larger percentage of stocks than bonds, but some take a more conservative approach and hold a larger percentage of bonds. Depending on your situation and risk tolerance, you might consider holding more than one balanced fund, one tilted toward stocks and the other tilted toward bonds. This could be helpful in tweaking your overall asset allocation. For example, you may invest more heavily in a stock-focused balanced fund while you are working and shift more assets to a bond-focused fund as you approach retirement.

Lower Highs, Higher Lows

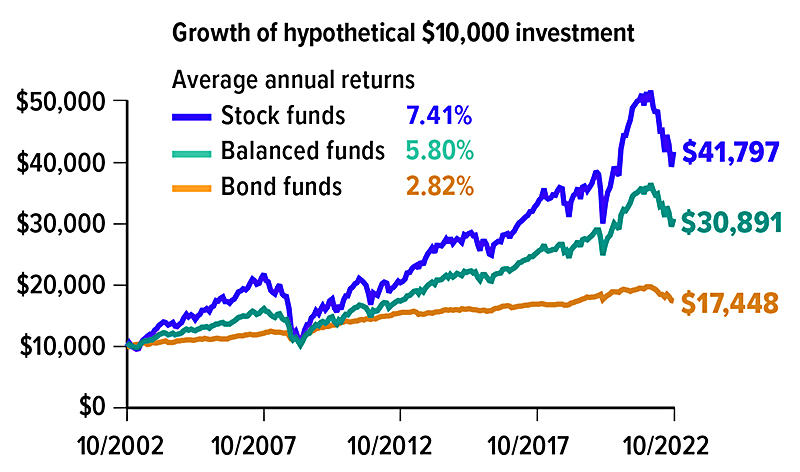

During the 20-year period ending in October 2022, balanced funds were less volatile than stock funds, while producing higher returns than bond funds.

Keep in mind that as you change the asset allocation and diversification of your portfolio, you may also be changing the level of risk. Asset allocation and diversification are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

The return and principal value of all investments fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Bond funds, including balanced funds, are subject to the same inflation, interest-rate, and credit risks associated with their underlying bonds. As interest rates rise, bond prices typically fall, which can adversely affect a bond fund’s performance.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. You should read the prospectus carefully before investing.

Prepared by Broadridge Advisor Solutions Copyright 2023.