As the beneficiary of an inheritance, you are most likely to be faced with making many important decisions during an emotional time. Short of meeting any required tax or legal deadlines, don’t make any hasty decisions concerning your inheritance.

Identify a Team of Trusted Professionals

Tax laws and requirements can be complicated. Consult with professionals who are familiar with assets that transfer at death. These professionals may include an attorney, an accountant, and a financial and/or insurance professional.

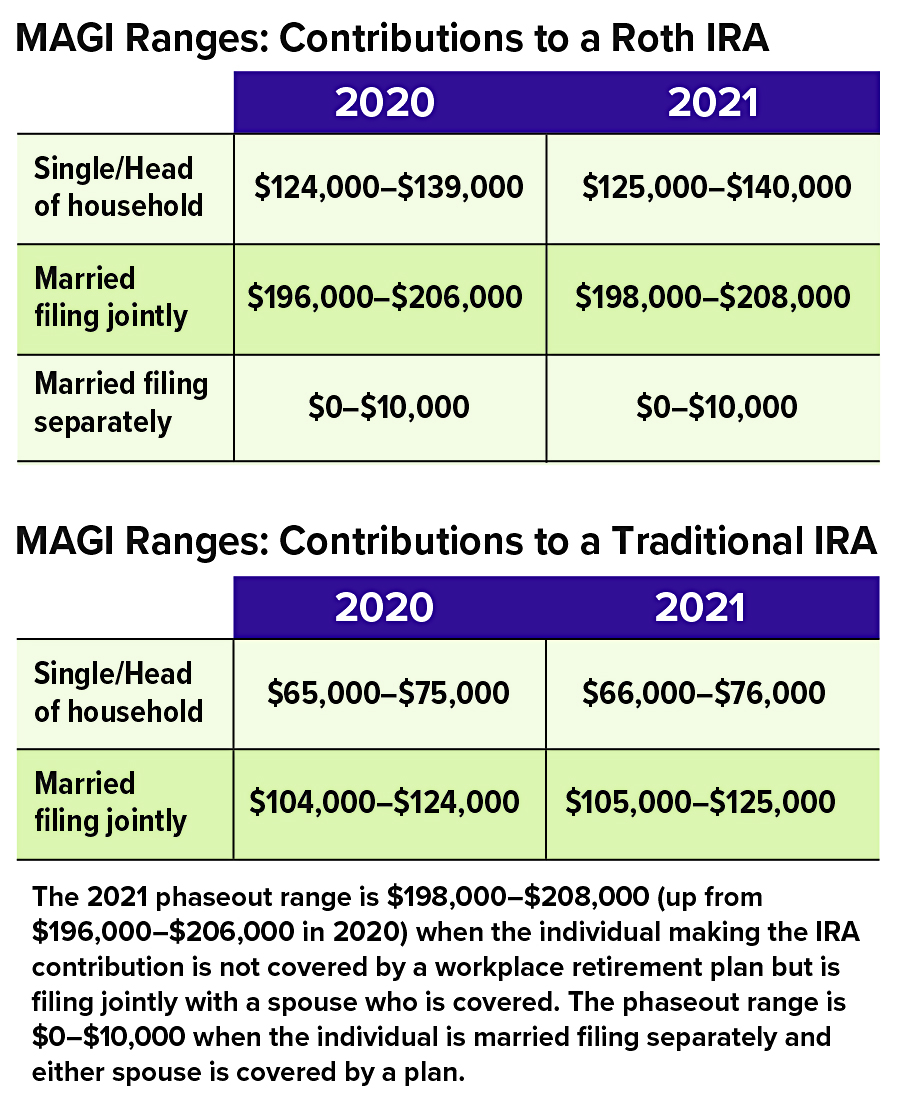

Be Aware of the Tax Consequences

Generally, you probably will not owe income tax on assets you inherit. However, your income tax liability may eventually increase. Any income that is generated by inherited assets may be subject to income tax, and if those assets produce a substantial amount of income, your tax bracket may increase. This is particularly true if you receive distributions from a tax-qualified retirement plan such as a 401(k) or an IRA. You may need to re-evaluate your income tax withholding or begin paying estimated tax.

You also may need to consider the amount of potential transfer (estate) taxes that your estate may owe, due to the increase in the size of your estate after factoring in your inheritance. You may need to consider ways to help reduce these potential taxes.

How You Inherit Assets Makes a Difference

Your inheritance may be received through a trust or you may inherit assets outright. When you inherit through a trust, you’ll receive distributions according to the terms of the trust. You may not have total control over your inheritance as you would if you inherited the assets outright.

Familiarize yourself with the trust document and the terms under which you are to receive trust distributions. You will have to communicate with the trustee of the trust, who is responsible for the administration of the trust and the distribution of assets according to the terms of the trust.

Even if you’re used to handling your own finances, receiving a significant inheritance may promote spending without planning. Although you may want to quit your job, or buy a car, a house, or luxury items, this may not be in your best interest. Consider your future needs, as well, if you want your wealth to last. It’s a good idea to wait at least a few months after inheriting money to formulate a financial plan. You’ll want to consider your current lifestyle and your future goals, formulate a financial strategy to meet those goals, and determine how taxes may reduce your estate.

Develop a Financial Plan

Once you have determined the value and type of assets you will inherit, consider how those assets will fit into your financial plan. For example, in the short term, you may want to pay off consumer debt such as high-interest loans or credit cards. Your long-term planning needs and goals may be more complex. You may want to fund your child’s college education, put more money into a retirement account, invest, plan to help reduce taxes, or travel.

Evaluate Your Insurance Needs

Depending on the type of assets you inherit, your insurance needs may need to be adjusted. For instance, if you inherit valuable personal property, you may need to adjust your property and casualty insurance coverage. Your additional wealth from your inheritance means you probably have more to lose in the event of a lawsuit. You may want to purchase an umbrella liability policy that can help protect you against actual loss, large judgments, and the cost of legal representation. You may also need to recalculate the amount of life insurance you need because of your inheritance. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased.

Evaluate Your Estate Plan

Depending on the value of your inheritance, it may be appropriate to re-evaluate your estate plan. Estate planning involves conserving your money and putting it to work so that it best fulfills your goals. It also means helping reduce your exposure to potential taxes and creating a comfortable financial future for your family and other intended beneficiaries.

Some things you should consider are to whom your estate will be distributed, whether the beneficiary(ies) of your estate are capable of managing the inheritance on their own, and how you can best shield your estate from estate taxes. If you have minor children, you may want to protect them from asset mismanagement by nominating an appropriate guardian or setting up a trust for them. If you have a will, your inheritance may make it necessary to make significant changes to that document, or you may want to make an entirely new will or trust. There are costs and ongoing expenses associated with the creation and maintenance of trusts and wills. Consult with an estate planning attorney for proper guidance.

Prepared by Broadridge Advisor Solutions Copyright 2021.