It’s heartbreaking to hear stories of people losing money (even their life savings) as a result of fraud or financial exploitation, especially if they are older and financially vulnerable. In fact, it’s quite common. People age 70 and older reported losses of $567 million in 2022.1 You know your parents could be at risk, and you want to protect them, but how?

One place to start is by looking for warning signs that your parents have been victimized, or are at risk of being influenced, manipulated, or coerced by a stranger or someone they know.

- Unusual bank account activity, including large or unexplained withdrawals, and nonsufficient fund notices

- Missing checks, credit cards, or financial statements

- Unpaid bills

- Lost money or valuables that can’t be located after a thorough search

- Relationships with people who seem to have undue influence

- Unexplained changes to legal documents

- Declining memory and decision-making skills

Regularly checking in with your parents may help you spot issues that need to be addressed. If your parents have fallen victim to a financial scam or are being pressured for money from someone they know, they may be embarrassed or reluctant to tell you, even if you ask. Do your best to remain objective and nonjudgmental, and patiently listen to their views while expressing your own concern for their well-being.

Laying some groundwork to help prevent future incidents is also important. For example, talk to your parents about how they might handle common scams. Let them know it’s a good idea to get a second opinion from you before acting on any request for information or money, even if it seems to come from their financial institution, a well-known company, law enforcement, a government agency such as the IRS or Social Security Administration, or even a grandchild in trouble.

Encourage them to set up appointments with their elder law attorney or financial professional to talk about concerns and legal and financial safeguards. They might also want to add layers of protection to their financial accounts, such as naming a trusted contact or setting up account alerts.

People are often reluctant to report financial fraud or exploitation, either out of embarrassment or fear of being wrong. But if you suspect your parents have been victimized, you can get help from many sources, including the National Elder Fraud Hotline, sponsored by the U.S. Department of Justice. You can call (833) 372-8311 to be connected with case managers who will assist you and direct you to additional resources.1) Federal Trade Commission, 2022

Prepared by Broadridge Advisor Solutions Copyright 2023.

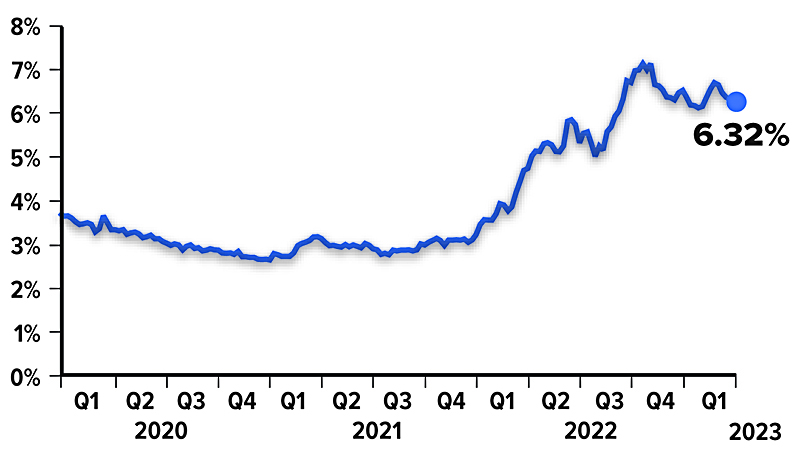

The mortgage industry has been on a roller coaster ride over the last couple of years. Interest rates for fixed-rate mortgage loans were at historical lows during the beginning of the pandemic in 2020, rising to a 20-year high in late 2022 — and fluctuating ever since. 1 Many buyers are finding it difficult to afford a new home with traditional fixed-rate mortgage loans in such a high interest rate environment. As a result, more buyers are relying on alternative financing options to help lower their interest rates.2

Adjustable-Rate Mortgages

With an adjustable-rate mortgage (ARM), also referred to as a variable-rate mortgage, there is a fixed interest rate at the beginning of the loan which then adjusts annually for the remainder of the loan term. ARM rates are usually tied to the performance of an index. To determine the ARM rate, the lender will take the index rate and add it to an agreed-upon percentage rate, referred to as the margin. Most lenders offer ARMs with fixed-rate periods of five, seven or 10 years, along with caps that limit the amount by which rates and payments can change.

The initial interest rate on an ARM is generally lower than the rate on a traditional fixed-rate mortgage, which will result in a lower monthly mortgage payment. However, depending on interest rates, buyers with ARMs may find themselves with significantly higher mortgage payments once the fixed-rate period ends. Buyers should only consider ARMs if they can tolerate fluctuations in their mortgage payments or plan on refinancing or selling the home before the initial interest rate period ends.

30-Year Fixed Mortgage Interest Rates, January 2020 to March 2023

Temporary Buydowns

A temporary buydown provides the buyer with a lower interest rate on a fixed-rate mortgage during the beginning of the loan period (e.g., the first one or two years) in exchange for an upfront fee or higher interest rate once the buydown feature expires. Buydowns typically offer large interest rate discounts (e.g., up to one to three percentage points, depending on the type of buydown). The costs associated with the buydown feature can be paid for by the home buyer, seller, builder, or mortgage lender.

While a buydown can make a home purchase more affordable at the beginning of the loan period, the long-term interest rates and mortgage payments on the loan can end up being substantially higher. This is why a borrower usually must initially qualify for the loan based on the full interest rate in effect after the buydown expires.

Assumable Mortgages

Assumable mortgages may be another way for buyers to circumvent high mortgage rates. An assumable mortgage is when a buyer takes over a seller’s existing loan and loan terms and pays cash or takes out a second mortgage to cover the remainder of the purchase price.

This type of loan could be advantageous if the existing loan has a low enough interest rate, and the buyer has enough access to cash or financing to cover the difference between the sale price and outstanding balance of the assumed loan. Not all mortgage loans are assumable — generally they are limited to certain types of government-backed loans (e.g., FHA, VA loans).

Other Incentives

One type of incentive offered by lenders is for a buyer to pay an upfront fee at closing, also known as points. By paying points at closing, buyers can reduce their interest rates — usually by around .25 percent per point — and lower their monthly mortgage loan payments. To make paying points cost effective, buyers should plan on staying in the home for several years so that they can recoup the costs. Sometimes a home builder or seller will offer to pay for points on a mortgage in order to attract more potential buyers.

Another incentive, often referred to as a “future refi,” is one that allows borrowers to purchase a home at current interest rates, with the ability to refinance their loans at a later date. The refinancing can be free or the costs can be rolled into the new loan, depending on the lender and loan type. Keep in mind that there is typically a set time period for refinancing with these types of loans.1-2) Consumer Financial Protection Bureau, 2022

Prepared by Broadridge Advisor Solutions Copyright 2023.

If 2023 has been financially challenging, why not take a moment to reflect on the progress you’ve made and the setbacks you’ve faced? Getting into the habit of reviewing your finances midyear may help you keep your financial plan on track while there’s still plenty of time left in the year to make adjustments.

Goal Overhaul

Rising prices put a dent in your budget. You put off a major purchase you had planned for, such as a home or new vehicle, hoping that inventory would increase and interest rates would decrease. A major life event is coming up, such as a family wedding, college, or a job transition.

Both economic and personal events can affect your financial goals. Are your priorities still the same as they were at the beginning of the year? Have you been able to save as much as you had planned? Are your income and expenses higher or lower than you expected? You may need to make changes to prevent your budget or savings from getting too far off course this year.

Post-Tax Season Estimate

Completing a midyear estimate of your tax liability may reveal planning opportunities. You can use last year’s tax return as a basis, then factor in any anticipated adjustments to your income and deductions for this year.

Check your withholding, especially if you owed taxes or received a large refund. Doing that now, rather than waiting until the end of the year, may help you avoid a big tax bill or having too much of your money tied up with Uncle Sam.

You can check your withholding by using the IRS Tax Withholding Estimator at irs.gov. If necessary, adjust the amount of federal income tax withheld from your paycheck by filing a new Form W-4 with your employer.

Investment Assessment

Review your portfolio to make sure your asset allocation is still in line with your financial goals, time horizon, and tolerance for risk. How have your investments performed against appropriate benchmarks, and in relationship to your expectations and needs? Looking for new opportunities or rebalancing may be appropriate, but be cautious about making significant changes while the market is volatile.

Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. All investing involves risk, including the possible loss of principal and there is no guarantee that any investment strategy will be successful.

Retirement Savings Reality Check

If the value of your retirement portfolio has dipped, you may be concerned that you won’t have what you need in retirement. If retirement is years away, you have time to ride out (or even take advantage of) market ups and downs. If you’re still saving for retirement, look for opportunities to increase retirement plan contributions. For example, if you receive a pay increase this year, you could contribute a higher percentage of your salary to your employer-sponsored retirement plan, such as a 401(k), 403(b), or 457(b) plan. If you’re age 50 or older, consider making catch-up contributions to your employer plan. For 2023, the contribution limit is $22,500, or $30,000 if you’re eligible to make catch-up contributions.

If you are close to retirement or already retired, take another look at your retirement income needs and whether your current investment and distribution strategy will provide enough income. You can’t control challenging economic cycles, but you can take steps to help minimize the impact on your retirement.

More to Consider:

Here are five questions to consider as part of your midyear financial review.

Prepared by Broadridge Advisor Solutions Copyright 2023.

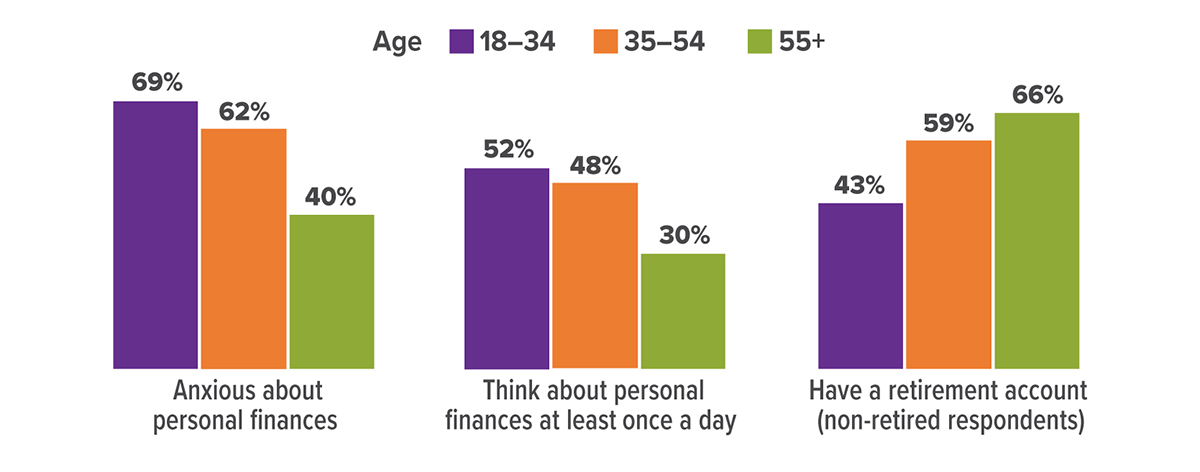

A study of financial capability found that older Americans were significantly less anxious about personal finances than younger people. However, about one-third of non-retired people 55 and older had no retirement account.

A comparison of the percentages regarding financial anxiety and retirement accounts suggests that having sufficient resources to contribute to a retirement account is an important aspect of feeling less financial stress for older people. However, many younger people feel stress regardless of whether they have retirement savings. This is especially true of those ages 35 to 54 who may have large mortgages, children in college, and other financial stressors.

Prepared by Broadridge Advisor Solutions Copyright 2023.

The IRS warns that although scams are especially prevalent during tax season, they also take place throughout the year.1 As a result, it’s important to always be on the lookout for suspicious activity so that you don’t end up becoming the victim of a scam.

One of the more common IRS scams involves phishing emails. These scams involve unsolicited emails that pose as the IRS to convince you to provide personal information. Scam artists then use this information to commit identity or financial theft. Another dangerous type of phishing, referred to as “spear phishing,” is targeted towards specific individuals or groups within a company or organization. Spear phishing emails are designed to get you to click on a link or download an attachment that will install malware in order to disrupt critical operations within your company or organization.

Another popular IRS scam involves fraudulent communications that appear to be from the IRS or a law enforcement organization. These scams are designed to trick you into divulging your personal information by using scare tactics such as threatening you with arrest or license revocation. Be wary of any email, phone, social media, and text communications from individuals claiming they are from the IRS or law enforcement saying that you owe money to the IRS.

A relatively new IRS scam involves text messages that ask you to click on a link in order to claim a tax rebate or some other type of tax refund. Scammers who send these messages are trying to get you to give up your personal information and/or install malware on your phone. Watch out for texts that appear to be from the IRS that mention “tax rebate” or “refund payment.”

The IRS will not initiate contact with you by email, text message, or social media to request personal information. The IRS usually contacts you by regular mail delivered by the U.S. Postal Service. Here are some steps that may help you avoid scams.

- Never share your personal or financial information via email, text message, or over the phone.

- Don’t click on suspicious or unfamiliar links or attachments in emails, text messages, or instant messaging services.

- Keep your devices and security software up to date, maintain strong passwords, and use multi-factor authentication.

1) Internal Revenue Service, 2022

Prepared by Broadridge Advisor Solutions Copyright 2023.